The demand for apartments and multi-family homes is rapidly increasing, creating significant opportunities for investors looking for strong returns. For more modern design inspiration, check out these modern family home designs. Understanding the latest design trends and financial strategies is crucial for success in this dynamic market. This comprehensive guide provides actionable insights into maximizing profitability in multi-family housing, from integrating smart technology to creating energy-efficient and community-focused homes. This guide offers practical advice for developers, investors, municipalities, and prospective residents alike.

Key Design Trends and Investment Opportunities in Multi-Family Housing

Modern apartment buildings are evolving beyond simple structures; they are becoming thriving communities and smart investments. This guide explores crucial design trends, financial considerations, and actionable steps for all stakeholders in the multi-family housing sector. By understanding these elements, you can create properties that attract tenants, reduce operating costs, and provide long-term value.

Shaping the Modern Apartment Experience: Top Design Innovations

What makes a modern apartment building truly stand out? The key is crafting a desirable and convenient living experience. Let’s examine the design trends driving this market:

1. Superior Soundproofing: Enhancing Peace and Quiet

Effective soundproofing is paramount for tenant satisfaction and retention. Employing dense insulation, sound-dampening drywall, and resilient channels significantly minimizes noise transmission between units and from external sources. While adding to initial construction costs, this investment leads to happier tenants, fewer complaints, and lower turnover rates. Consider adding soundproof windows and doors for enhanced acoustic isolation.

2. Energy Efficiency: Sustainable and Cost-Effective Design

Embracing sustainable designs is not only environmentally responsible but also financially advantageous. Shared, high-efficiency HVAC systems, advanced insulation materials, and on-site solar panels substantially reduce operating costs for both owners and tenants, directly increasing property value. Smart thermostats and energy monitoring systems further optimize energy use, providing real-time data and control. Explore options for rainwater harvesting and greywater recycling to further reduce utility costs.

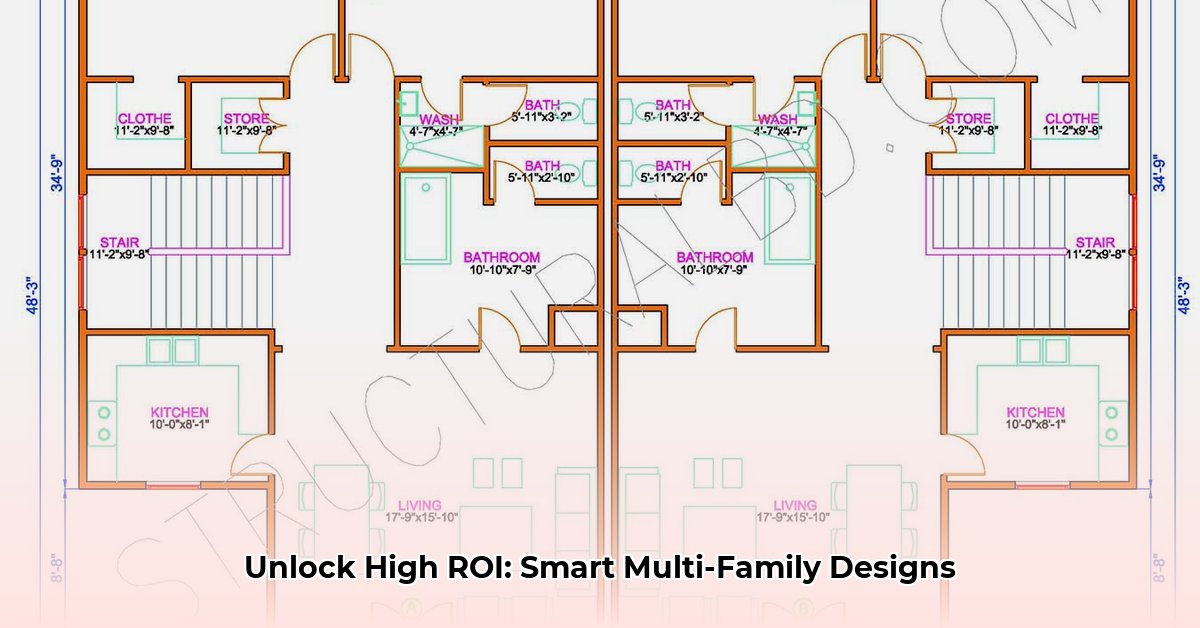

3. Flexible Floor Plans: Adapting to Modern Lifestyles

Today’s diverse lifestyles demand adaptable living spaces. Open-concept designs with easily convertible spaces are highly desirable. Features like movable walls, modular furniture, and multi-functional rooms allow tenants to customize their living environment. A den that can transform into a home office, a living/dining area with partial separation for privacy, or a guest room that doubles as a workout space adds significant value. Consider built-in storage solutions to maximize space and minimize clutter.

4. Community Amenities: Fostering a Sense of Belonging

Modern apartment living is increasingly focused on creating a sense of community. Thoughtfully designed communal spaces encourage interaction and enhance resident satisfaction. Courtyards with outdoor seating, rooftop gardens with BBQ areas, co-working spaces with high-speed internet, well-equipped fitness centers, and dedicated pet parks attract residents willing to pay a premium. Consider adding amenities like package lockers, bike storage, and electric vehicle charging stations to further enhance the appeal of your building. Organize community events and activities to foster a stronger sense of belonging.

5. Smart Home Technology: Embracing Convenience and Efficiency

Smart features are rapidly becoming standard expectations for modern renters. Keyless entry systems, automated lighting controls, and remote temperature management enhance resident convenience and streamline property management. Integrate smart appliances, such as refrigerators and washing machines, to further improve energy efficiency. Remote control of HVAC systems optimizes energy consumption, allows for predictive maintenance, and makes buildings more attractive to tech-savvy renters. Consider offering high-speed internet and smart home integration as part of the rental package.

Financial Strategies for Multi-Family Housing Investment

Building apartments requires meticulous financial planning to ensure profitability and long-term sustainability. Let’s explore key aspects to guarantee a successful investment:

1. Comprehensive Rental Yield Projections: Market Analysis and Strategic Site Selection

Conduct thorough research of the local rental market to identify high-potential areas. Analyze comparable properties, track average vacancy rates, and assess local economic trends, including job growth and demographic shifts. Solid market research forms the foundation of a successful project by guiding site selection and informing rental rate strategies. Consider factors like proximity to public transportation, schools, and amenities when evaluating potential sites.

2. Optimized Construction Costs: Efficient Techniques and Sustainable Materials

Construction costs can significantly impact the profitability of a multi-family project. Careful planning and cost-effective building techniques are vital for staying within budget. Explore prefabricated components, lean construction methods, and sustainable materials to control costs without sacrificing quality or durability. Consider value engineering to identify areas where costs can be reduced without compromising the integrity of the design. Negotiate favorable contracts with suppliers and subcontractors to minimize expenses.

3. Strategic Financing Options: Diverse Strategies and Robust Risk Mitigation

Securing adequate funding is a crucial step in multi-family development. Explore a range of financing options, including traditional bank loans, private equity investments, and crowdfunding platforms. Consult with financial advisors specializing in real estate development to navigate the complexities of financing and identify the most suitable options for your project. Develop a detailed financial model that incorporates various scenarios and stress tests to assess the project’s resilience to market fluctuations.

4. Proactive Regulatory Compliance: Zoning and Building Codes

Thorough understanding of local zoning laws and building codes is essential to avoid costly delays and legal issues. Consult with experienced architects, contractors, and legal professionals familiar with local ordinances to ensure full compliance. Conduct a comprehensive due diligence review of potential sites to identify any potential zoning restrictions or environmental concerns. Engage with local authorities early in the planning process to build rapport and address any potential concerns proactively. What permits are needed?

Actionable Steps for Stakeholders in Multi-Family Development

Collaboration and communication are key to success in multi-family development. Consider these actionable steps for each stakeholder:

| Stakeholder | Actionable Steps |

|---|---|

| Developers/Builders | Prioritize sustainable materials and energy-efficient designs; engage with local authorities early in the planning process for collaboration and feedback; conduct thorough market research to identify unmet demand and tailor projects to specific needs. |

| Investors | Diversify portfolios geographically and across different property types; use data-driven decision-making to identify promising investment opportunities; conduct thorough due diligence to assess risks and potential returns; seek expert advice to mitigate risks. |

| Municipalities/Governments | Streamline permitting processes to expedite development; incentivize sustainable building practices through tax breaks, zoning incentives, and density bonuses; engage with developers and community members to address concerns and promote responsible development. |

| Residents | Research buildings with desirable amenities, energy efficiency, and community features; provide feedback to property managers to improve the living experience; participate in community events to foster a sense of belonging; advocate for sustainable practices. |

Mitigating Risks in Multi-Family Development

Even with careful planning, multi-family development projects can be subject to various risks. Here are potential risks and effective mitigation strategies:

| Risk Factor | Mitigation Strategy |

|---|---|

| Rising Construction Costs | Explore value engineering options to reduce costs without compromising quality; utilize prefabrication techniques to improve efficiency and reduce labor costs; negotiate fixed-price contracts with suppliers and subcontractors to mitigate price fluctuations. |

| Regulatory Hurdles | Engage early with local officials to understand permitting requirements and address potential concerns; consult legal experts familiar with local codes and zoning laws to ensure full compliance; maintain open communication with regulatory agencies to resolve issues promptly. |

| Vacancy Rates | Offer competitive amenities and pricing to attract tenants; actively manage the property to address maintenance issues and tenant concerns; implement effective marketing strategies to promote the property; conduct regular market analysis to adjust rental rates accordingly. |

| Economic Downturn | Diversify investments across multiple properties and locations to reduce exposure to market fluctuations; maintain healthy financial reserves to weather economic downturns; implement cost-cutting measures to reduce operating expenses; focus on tenant retention to minimize vacancy rates. |

| Environmental Concerns | Prioritize eco-friendly materials and construction practices to minimize environmental impact; seek LEED certification to demonstrate commitment to sustainability; implement energy-efficient technologies to reduce carbon footprint; conduct environmental assessments to identify and mitigate potential risks. |

The modern multi-family housing market is constantly evolving. By staying informed about emerging trends, making data-driven financial decisions, and proactively managing risks, you can create successful and profitable multi-family communities. Continuous research, adaptation, and a commitment to excellence are essential for long-term success in this dynamic industry.

How to Calculate Rental Yield for Multifamily Properties by Region

Key Takeaways:

- Mastering key metrics like Cap Rate, NOI, and Cash-on-Cash Return is crucial for initial assessments.

- Advanced valuation techniques, including discounted cash flow analysis and long-term appreciation projections, are vital for experienced investors.

- Local market conditions significantly impact rental yields, highlighting the need for region-specific research.

Understanding Rental Yield: The Foundation

Rental yield represents the return on your investment based on rental income. A higher yield indicates a more profitable investment. Calculations involve factoring in the initial investment cost, ongoing expenses, and potential appreciation.

The basic formula: (Annual Rental Income – Annual Expenses) / Total Investment Cost x 100 = Rental Yield %.

Accurately forecasting annual income and expenses is crucial, especially with multifamily properties. Vacancy rates, property management fees, maintenance costs, insurance, and property taxes all play major roles in determining overall profitability

- Glass Mosaic Backsplash: A Stylish Upgrade For Your Kitchen - December 8, 2025

- Glass Tile Shower Ideas to Create a Stunning Bathroom Space - December 7, 2025

- Glass Wall Tile Ideas for Kitchens and Bathrooms - December 6, 2025