Discover how a home warranty insurance calculator [1. Home Warranty Insurance Calculator: A Homeowner’s Guide to Savings] empowers homeowners to estimate repair costs, compare plans, and safeguard their properties. This comprehensive guide provides insights into the benefits of using a calculator to simplify the decision-making process and ensure peace of mind in protecting your home and savings.

Key Takeaways:

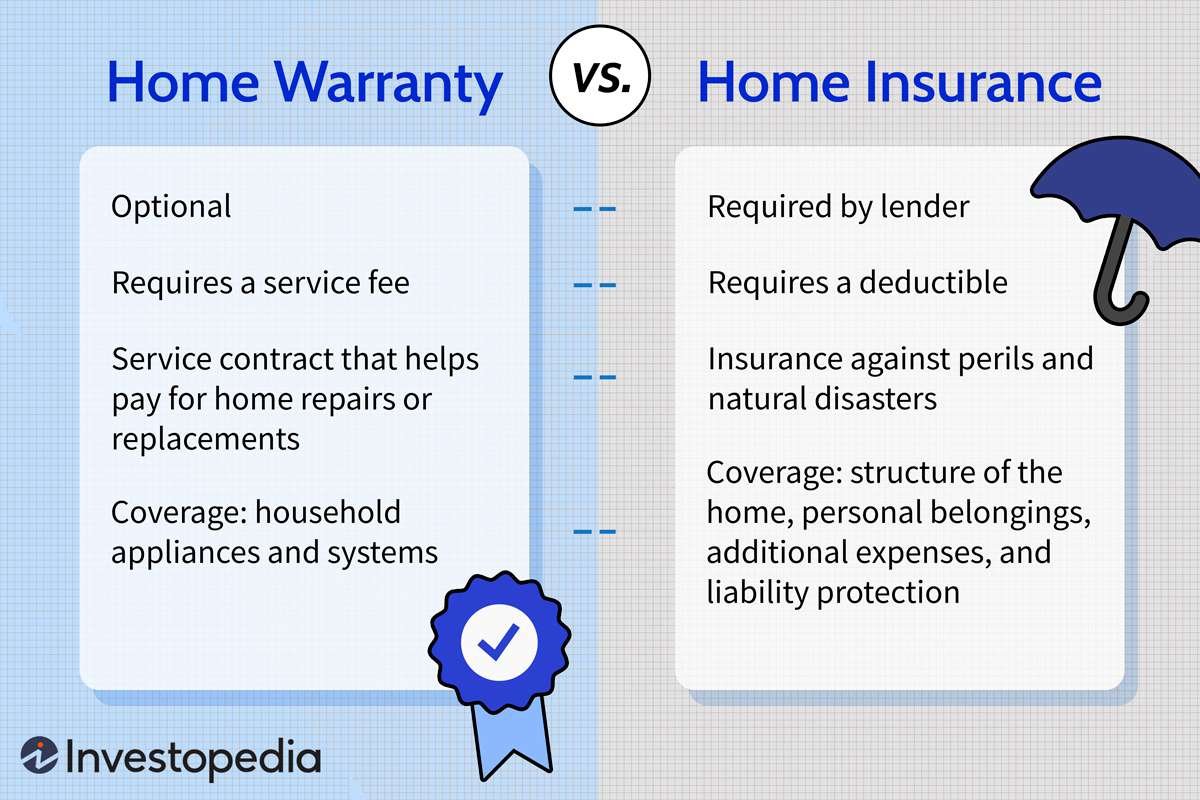

- Home warranty insurance covers repair costs for damaged appliances and systems.

- Premiums vary based on home and appliance details.

- Lower premiums by increasing the deductible, shortening coverage, or bundling policies.

- Insurance provides peace of mind and potential savings over time.

Home Warranty Insurance Calculator: Your Key To Financial Peace

When buying a home, safeguard your investment with a home warranty insurance calculator. This tool helps you estimate the cost of coverage, providing valuable insights for informed decision-making.

How Does A Home Warranty Insurance Calculator Work?

These calculators typically consider factors like:

- Home location and size

- Age and condition of appliances and systems

- Level of desired coverage

Simply input relevant details, and the calculator generates an estimated premium range.

Benefits of Using A Home Warranty Insurance Calculator

- Budget Planning: Estimate potential costs and make informed decisions about coverage options.

- Cost Comparisons: Quickly compare different providers and coverage levels to find the best value.

- Personalized Estimates: Tailor calculations to your specific home and coverage needs.

Tips For Lowering Premiums

- Increase your deductible.

- Opt for a shorter coverage period.

- Bundle multiple policies with the same insurer.

Conclusion

A home warranty insurance calculator empowers you to safeguard your home and finances with confidence. By understanding the costs involved, you can make informed choices that provide peace of mind and financial protection.

Are you searching for a local cafe that caters to homegrown menu? Check out our homegrown cafe menu.

Planning your shopping for home appliances? Find out more about our home value stores.

Whatever your appliance needs are, our home value stores have everything you need if you’re based in Ireland.

If you’re in need of a vet for your beloved pet but do not wish to travel, take advantage of this home visit vet in Melbourne.

Calculating Estimated Repair Costs by System

Picture this: you’re a homeowner, enjoying the comforts of your abode, when suddenly, your heating system starts acting up. Panic sets in as you realize the potential cost of repairs. But what if there was a way to estimate these expenses beforehand? Enter home warranty insurance calculators.

Benefits of Home Warranty Insurance Calculators:

- Know the Numbers: Get a ballpark figure for the annual cost of coverage, helping you plan your budget.

- Compare Options: Evaluate different plans and see which fits your needs and budget best.

- Tailored Estimates: Factor in your home’s details like size, age, and appliances, for a personalized estimate.

Estimating Repair Costs by System:

Home warranty insurance calculators typically break down costs by system, giving you a clearer understanding of potential repair expenses. Here’s how:

-

Major Appliances: Calculators estimate the likelihood and cost of repairs for appliances like refrigerators, ovens, and dishwashers.

-

Plumbing: Predict expenses associated with leaks, clogged drains, and faulty fixtures.

-

Electrical: Get insights into the potential costs of electrical repairs, including wiring issues, outlet replacements, and lighting problems.

-

HVAC: Estimate the cost of repairing or replacing heating, ventilation, and air conditioning systems, ensuring comfort and air quality.

Key Takeaways:

- Home warranty insurance calculators provide estimates for annual coverage costs and repairs by system.

- By considering factors like home details and coverage level, you can get personalized estimates.

- Calculators help with budgeting, comparing plans, and planning for unexpected repair expenses.

Relevant Sources:

Comparing Coverage Options and Premiums

Home warranty insurance calculators are powerful tools that estimate the cost of coverage based on your home’s characteristics. They empower you to compare premiums and coverage options, ensuring you get the protection you need at a price that fits your budget.

Key Takeaways:

- Home warranty insurance calculators provide personalized cost estimates based on factors like home size, age, location, and desired coverage level.

- Comparing coverage options and premiums allows you to find the best value for your money.

- Consider the deductible, coverage period, and bundled policies to lower premiums.

Cost Estimation

Monthly premiums for home warranty insurance in the US range from $280 to $1,465 per year, with an average of $58.40 per month [1]. Service call fees typically fall between $65 and $130 per visit.

Comparing Options

To Compare Coverage Options and Premiums, gather quotes from multiple providers. Consider the coverage level, which ranges from basic to comprehensive, typically covering major appliances, heating/cooling systems, plumbing, and electrical systems [2]. Annual coverage limits generally start at $3,000 and can extend to $6,000 or more.

Lowering Premiums

If you’re looking to lower premiums, you can:

- Increase the deductible: Higher deductibles reduce premiums.

- Choose a shorter coverage period: One-year coverage is typically less expensive than extended periods.

- Bundle policies: Insuring your home with the same provider as your auto or property insurance can qualify you for discounts.

Empower yourself with the knowledge of home warranty insurance calculators and Compare Coverage Options and Premiums to ensure you have the protection you need without breaking the bank.

Citations:

[1] NerdWallet:

[2] This Old House:

Making an Informed Decision on Home Warranty Insurance

When it comes to Making an Informed Decision on Home Warranty Insurance, cost is a crucial factor to consider. Home warranty costs can vary based on location, coverage level, and other factors. So how do you ensure you’re getting the best value for your money?

Enter Home Warranty Insurance Calculators. These online tools provide personalized estimates based on your specific needs and preferences.

Benefits of Using a Home Warranty Insurance Calculator

- Budget Planning: Determine the approximate cost of coverage before committing.

- Cost Comparisons: Compare quotes from multiple providers side-by-side to find the best deal.

- Personalized Estimates: Get a tailored estimate that considers factors specific to your home.

Factors Affecting Home Warranty Insurance Costs

- Location: Costs can vary significantly by region.

- Coverage Level: More comprehensive coverage options will naturally cost more.

- Service Call Fee: Some plans charge a fee for each service visit.

- Number of Claims Expected: Insurers consider the likelihood of claims when setting premiums.

Tips for Lowering Home Warranty Premiums

- Increase Deductible: Raising your deductible can reduce your premium.

- Choose a Shorter Coverage Period: A one-year plan will typically cost less than a multi-year plan.

- Bundle Policies: Insuring multiple homes or policies with the same insurer can sometimes lead to discounts.

Key Takeaways:

- Home warranty insurance calculators help homeowners make informed decisions about coverage and cost.

- Costs vary based on location, coverage level, and other factors.

- Consider raising the deductible, choosing a shorter coverage period, and bundling policies to lower premiums.

Relevant URL Sources:

- Home Warranty Cost Calculator

- How Much Does a Home Warranty Cost?

FAQ

Q1: What are the benefits of using a home warranty insurance calculator?

Q2: How can I find the best home warranty insurance policy for my needs?

Q3: What factors affect the cost of home warranty insurance?

Q4: What is the average cost of home warranty insurance?

Q5: What are the different types of home warranty insurance plans available?

- Upgrade Your Table Setting: Best Salad Forks 2025 - June 26, 2025

- Sage Green Throw Pillows: Transform Your Home Decor - June 26, 2025

- Find the Perfect Sage Green Rug: A Buyer’s Guide - June 26, 2025