Does Homeowners Insurance Cover Main Water Line Replacement?: A Comprehensive Guide to Coverage, Exclusions, and Claims

Key Takeaways:

-

Standard homeowners insurance usually doesn’t cover repairs or replacements for the main water line outside your house.

-

A few insurance companies and service providers offer coverage for water line breaks.

-

Utility companies may have home warranty contracts for water main breaks, but these are not insurance policies.

-

On average, replacing a main water line costs $3,750.

Does Homeowners Insurance Cover Main Water Line Replacement?

Understanding the intricacies of homeowners insurance policies can be daunting, especially when dealing with specific coverage aspects like main water line replacement. While standard homeowners insurance policies generally don’t cover the repair or replacement of the main water line outside your house, understanding your policy details and exploring other options is key to addressing this concern effectively.

Homeowners Insurance Coverage for Main Water Line Replacement

Typically, homeowners insurance policies don’t extend coverage to the main water line situated outside your property. This exclusion arises from the fact that the main water line is considered part of the public water supply system and is, therefore, the responsibility of the local municipality or water utility company.

Alternatives to Homeowners Insurance for Main Water Line Coverage

Despite the standard exclusion, there are alternatives to homeowners insurance that can provide coverage for main water line replacement:

-

Endorsements or Riders: Some insurance companies offer endorsements or riders that can be added to your homeowners insurance policy to extend coverage to the main water line. These endorsements or riders typically come at an additional cost.

-

Separate Coverage: Some insurance companies or service providers offer standalone coverage specifically for water line breaks. These policies typically cover the cost of repair or replacement of the main water line, as well as any associated damage.

-

Home Warranty Contracts: Utility companies may offer home warranty contracts that include coverage for main water line breaks. These contracts are not insurance policies but can provide peace of mind by covering the cost of repairs or replacements.

Steps to Take if You Experience a Main Water Line Break

-

Contact Your Insurance Provider: If you have any coverage for main water line replacement, contact your insurance provider immediately. They will guide you through the claims process and determine the extent of coverage available.

-

Document the Damage: Take photos and videos of the damage caused by the main water line break. Keep any receipts or invoices related to the repairs or replacements.

-

Obtain Estimates for Repairs: Get estimates from licensed and reputable contractors for the repair or replacement of the main water line.

-

File a Claim: Submit the claim to your insurance provider along with the necessary documentation, including photos, videos, invoices, and estimates.

-

Cooperate with the Insurance Company: Work with the insurance company’s claims adjuster to provide any additional information or documentation they may require.

Conclusion

Whether homeowners insurance covers main water line replacement depends on your specific policy and the availability of additional coverage options. Exploring these alternatives, such as endorsements, separate coverage, or home warranty contracts, can provide you with peace of mind knowing that you’re protected in case of a main water line break.

When your home’s windows need replacing, find out if homeowners insurance covers replacement windows, or if siding needs replacing, learn if homeowners insurance covers siding too. Additionally, if you’re experiencing a slab leak, discover if homeowners insurance covers slab leak repair. Finally, if you require structural repairs, check if homeowners insurance covers structural repairs.

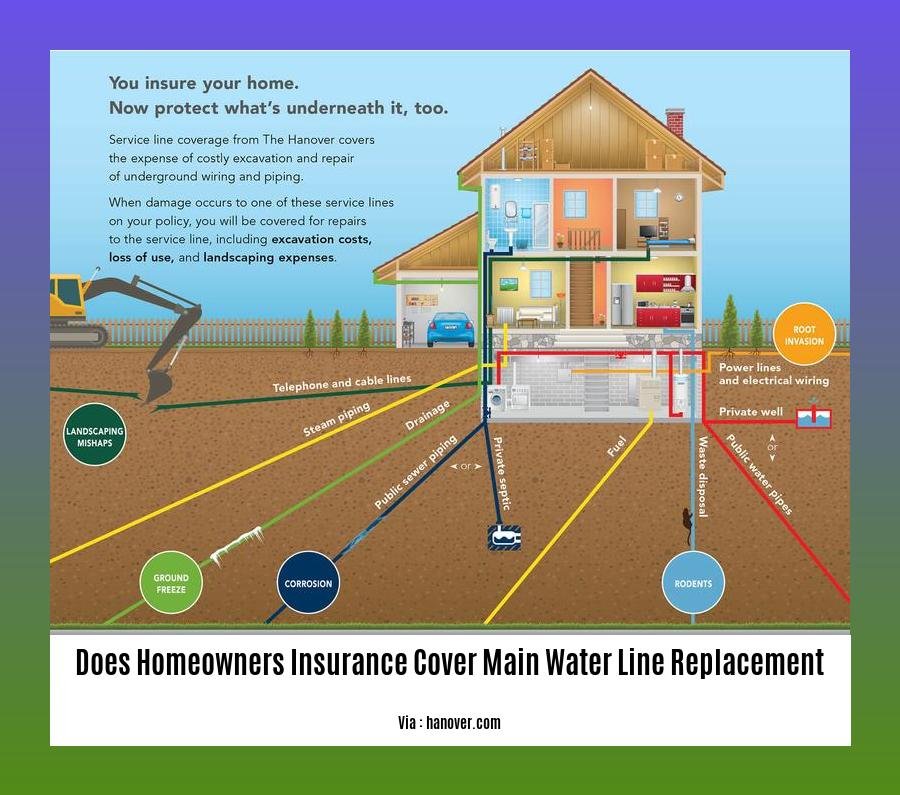

How Damage to Water Lines Occurs

It’s important to understand how damage to water lines can arise to ascertain whether homeowners insurance covers main water line replacement. Various factors contribute to water line damage, and awareness of these causes can help homeowners take proactive measures to protect their property.

Key Takeaways:

- Homeowners insurance typically excludes coverage for main water line repair or replacement due to its location outside the house.

- Damage caused by ruptures in water lines may be covered under some policies.

- Specialty insurance options or riders to the homeowners’ coverage policy can provide coverage against water line breaks.

- The average cost for main water line replacement is roughly $3,750.

How Damage to Water Lines Occurs

Water lines are vulnerable to damage from several sources, including:

- Ground Movement: Shifting soil and earthquakes can cause the ground to move, putting stress on water lines and potentially leading to breaks.

- Tree Roots: Aggressive tree roots can grow and penetrate water lines, causing cracks and leaks.

- Corrosion: Aging pipes made of certain materials, such as copper or galvanized steel, are susceptible to corrosion, which can weaken the pipes and make them prone to leaks.

- Freezing Temperatures: Water lines that are exposed to freezing temperatures can freeze and burst, causing significant damage.

- Construction or Excavation: Accidental damage to water lines can occur during construction or excavation projects in or around the property.

Protecting Your Water Lines

Homeowners can take proactive steps to minimize the risk of damage to their water lines, such as:

- Regular Inspections: Periodically check for signs of corrosion, leaks, or other damage to your water lines, especially if they are aging or made of susceptible materials.

- Insulate Exposed Pipes: If you have exposed water lines in areas prone to freezing temperatures, consider insulating them to prevent freezing and potential bursts.

- Maintain Trees and Landscaping: Keep trees and shrubs trimmed away from water lines to prevent root intrusion and damage.

- Choose Durable Materials: If replacing or installing new water lines, opt for durable materials that are less susceptible to corrosion and leaks, such as PEX or PVC pipes.

Conclusion

Understanding the causes of water line damage and taking preventive measures can help homeowners minimize the risk of costly repairs or replacements. While standard homeowners insurance may not cover main water line repairs, additional coverage options may be available through endorsements or specialty insurance policies. Consulting with an insurance professional can provide homeowners with a clear understanding of their coverage options and the steps to take in the event of water line damage.

Citations:

[1] Does Homeowners Insurance Cover Main Water Line Replacement? (Waffle Insurance, 2023):

[2] Does Homeowners Insurance Cover Sewer Lines? (Bankrate, 2023):

Understanding Homeowners Insurance

Homeownership comes with a unique set of responsibilities, including understanding the intricacies of your homeowners insurance policy. One common question that arises is whether homeowners insurance covers the replacement of the main water line. Let’s delve into the details to help you better understand homeowners insurance and its coverage.

Key Takeaways:

- Typically, homeowners insurance does not cover main water line replacement due to its location outside the house’s structure.

- Some insurance companies offer specialty coverage or endorsements for water line breaks or damage caused by covered perils.

- Homeowners can minimize the risk of water line damage through regular inspections, maintenance, and proper landscaping.

Generally, the main water line connecting your home to the municipal water supply is not covered under standard homeowners insurance policies. This is because the water line is considered to be outside the structure of the house and is therefore not covered by the policy’s dwelling coverage. However, there might be exceptions to this rule, and it’s important to carefully read your policy to determine the specific coverage provided.

In some cases, homeowners insurance may provide coverage for damage caused by a water leak or rupture inside the home. This includes damage to walls, floors, and personal property caused by the water leak. Some insurance companies might also offer specialty coverage or endorsements that extend coverage to the main water line. These endorsements typically come with additional premiums and may vary in terms of the coverage they provide.

To mitigate the risk of water line damage, homeowners can take proactive steps such as conducting regular inspections, insulating exposed pipes, maintaining trees and landscaping near the water line, and choosing durable materials for the water line. Additionally, it’s advisable to keep a copy of your homeowners insurance policy readily available and review it periodically to fully understand homeowners insurance.

Citations:

- Waffle Insurance: Does Homeowners Insurance Cover Main Water Line Replacement?

- AARP: Do You Need Water Line Insurance?

FAQ

Q1: Does standard homeowners insurance cover main water line replacement?

A1: Typically, standard homeowners insurance does not cover the repair or replacement of the main water line outside your house. However, some companies offer riders or endorsements that may provide limited coverage for this.

Q2: What alternatives are there for coverage against main water line breaks?

A2: Some insurance companies provide coverage against water line breaks, and utility companies may offer home warranty contracts that cover water main breaks. These contracts are usually offered by third parties and not the utility company itself.

Q3: What is the typical cost of replacing a main water line?

A3: The average cost to replace a main water line is around $3,750. However, this can vary depending on the length and location of the line, as well as the severity of the damage.

Q4: What causes damage to water lines?

A4: Damage to water lines can occur due to various factors, including ground movement, tree root interference, freezing temperatures, or corrosion.

Q5: Does homeowners insurance cover pipe replacement?

A5: Homeowners insurance typically covers damage caused by water leaks or ruptures inside the home, including damage to walls, floors, and personal property. When a pipe bursts inside the house, homeowners insurance may cover the cost of repairing or replacing the damaged pipe and the resulting water damage.

- Upgrade Your Table Setting: Best Salad Forks 2025 - June 26, 2025

- Sage Green Throw Pillows: Transform Your Home Decor - June 26, 2025

- Find the Perfect Sage Green Rug: A Buyer’s Guide - June 26, 2025