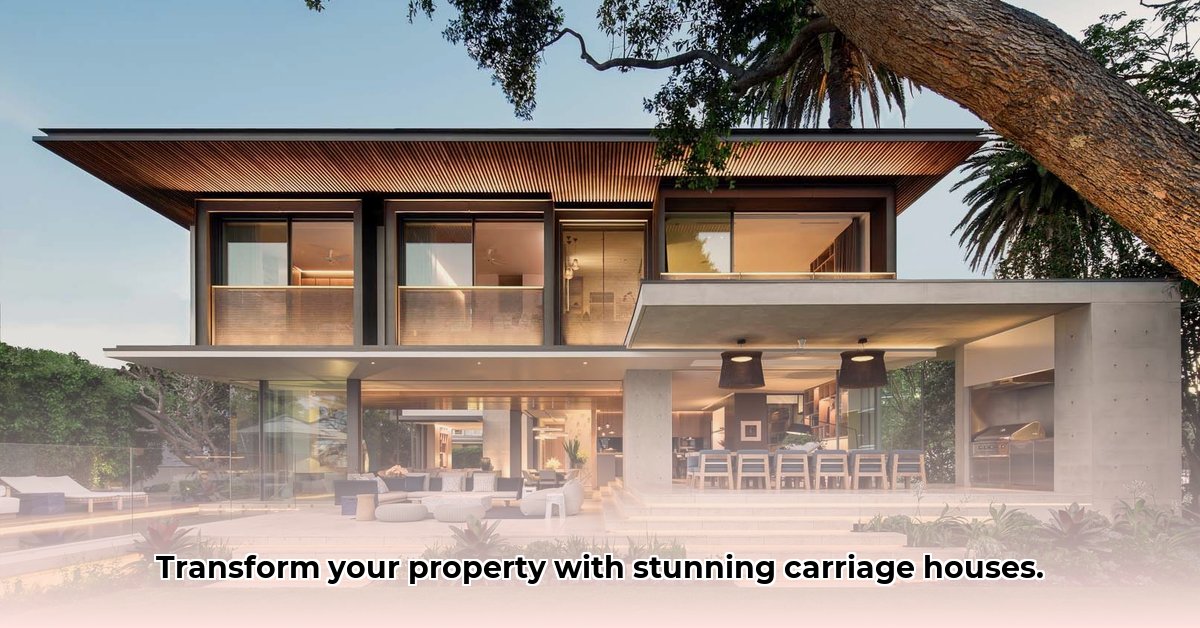

Want to add serious value to your home and create an awesome space? Think carriage house! This isn’t your grandma’s dusty old carriage house; we’re talking stylish, modern additions that can dramatically upgrade your property. For more space-saving design ideas, check out these narrow lot home designs. We’ll walk you through everything you need to know, from initial design ideas to the actual build, including tips to ensure your investment is smart and sustainable. We’ll even break down the costs and benefits to help you decide if a carriage house is the perfect fit for your needs. Discover how a carriage house can transform your home and your life – it’s more attainable than you think!

Modern Carriage House Designs: Unlock Your Property’s Full Potential

Adding a modern carriage house to your property is a significant way to boost its value and enhance your lifestyle. It’s more than just an attractive addition; it’s a strategic investment with numerous benefits. Let’s explore how you can turn this vision into reality and the crucial elements that contribute to a modern carriage house’s increasing value.

Why Build a Modern Carriage House? Exploring the Benefits

Consider this: a stylish, functional space on your property that can adapt to various needs. A private guest house for visiting family and friends? A dedicated home office, providing a quiet escape from the main house? Or perhaps a rental unit, generating additional income? A modern carriage house offers all these possibilities and more. It combines historical charm with contemporary design, creating an appealing addition that increases your home’s overall appeal and market value. It’s an investment that benefits you and your family for years to come. The rise in Accessory Dwelling Units (ADUs) has made carriage houses a sought-after asset, potentially increasing property values significantly.

Designing Your Ideal Carriage House: Size, Style, and Functionality

Planning your carriage house requires careful deliberation. Start by determining the size. While most range from 600 to 1,200 square feet, the ideal size depends on your specific needs. Will it be a compact guest suite, a versatile multi-purpose space, or a spacious apartment suitable for renting? Let its intended use inform your decisions.

Next, consider the architectural style. Do you envision sleek, minimalist lines complementing a modern home or a more traditional design that integrates seamlessly with older architecture? The options are vast! Remember to consider your main house’s style and your property’s landscape. Aim for harmony and integration. A cohesive design is crucial for maximizing visual appeal and property value. Incorporate natural, durable materials like sustainably sourced wood and weather-resistant stone for lasting appeal.

Finally, prioritize the interior design. Create a comfortable and convenient space with modern amenities such as energy-efficient heating and cooling (HVAC), high-speed internet, and abundant natural light. Prioritizing energy efficiency provides long-term cost savings and reduces your environmental footprint. Consider using sustainable materials; it’s beneficial for the environment and may offer tax advantages.

Building Your Carriage House: A Comprehensive Guide

Building a carriage house is a significant undertaking, but it’s achievable with a systematic approach. Here’s a roadmap to guide you through the process, including factors to consider during construction for Accessory Dwelling Units (ADU):

Step 1: Zoning and Regulations Review: Begin by thoroughly researching your local government’s zoning regulations. These rules govern Accessory Dwelling Units (ADUs), including carriage houses, and will dictate what you can and cannot build. Understand setbacks, height restrictions, and other limitations.

Step 2: Secure Financing: Explore various financing options, ranging from home equity loans to construction loans. Obtain pre-approval to establish your budget before commencing the design phase. Consult with financial advisors to determine the best approach.

Step 3: Selecting Your Builder: Find a reputable builder with experience in both traditional and modern construction techniques. Check references, thoroughly review their portfolio, and confirm their comfort level with your chosen design and materials. Obtain multiple bids to ensure competitive pricing.

Step 4: Obtaining Permits: The permitting process can be lengthy, so plan accordingly. Gather all required documentation and be prepared for potential delays. A well-organized approach will minimize complications. Work closely with your builder and local authorities to ensure compliance.

Step 5: Construction Management: Remain actively involved throughout the construction process. Maintain regular communication with your builder to ensure that everything progresses smoothly and aligns with your plan. Conduct site visits to monitor progress and address any concerns promptly.

The Financial Aspects: Return on Investment and Long-Term Value

Constructing a carriage house is an investment. While the initial costs can be considerable, the potential return on investment (ROI) can be significant. Several factors influence your ROI, including your local real estate market, overall construction expenses, and how you intend to use the space (rental or personal use).

A rental unit can generate a steady income stream, while a private guest house offers unparalleled convenience for visitors. You must also consider property taxes, insurance costs, and potential maintenance expenses. Thorough financial planning – encompassing anticipated costs and potential income – is crucial to ensure this investment aligns with your budget.

Perspectives from Key Stakeholders

Adding a carriage house benefits various groups:

- Homeowners: Enjoy enhanced property value, additional living space, and potential rental income.

- Architects and Designers: Express their creativity and influence modern design trends.

- Contractors: Benefit from new job opportunities and specialization in ADU construction.

- Local Governments: Experience increased housing density and a potential boost in property tax revenue.

- Real Estate Agents: Can market properties with carriage houses as highly desirable assets, increasing commission opportunities.

Potential Challenges and Effective Mitigation Strategies

While the advantages are substantial, potential challenges exist:

Pros:

- Increased Property Value

- Additional Living Space

- Potential Rental Income

- Enhanced Curb Appeal

- Greater Flexibility

- Improved Lifestyle

Cons:

- High Initial Investment Cost

- Complex Permitting Process

- Potential Zoning Restrictions

- Reliance on Skilled Labor

- Potential for Cost Overruns

These challenges can be managed with proactive planning and expert advice. Conduct thorough research on zoning regulations, create a detailed budget, and select experienced professionals to navigate potential hurdles. Don’t hesitate to seek guidance from multiple experts to ensure a successful project.

Your Modern Carriage House Awaits: Final Thoughts

Modern carriage house designs are more than just a trend; they represent a smart, versatile approach to maximizing your property’s potential. They significantly enhance your property’s value, offer incredible living space flexibility, and provide opportunities for income generation. The key to success lies in careful planning and active engagement throughout the process. With the right knowledge and approach, your dream carriage house is within reach. Start planning today and unlock the hidden value of your property!

How to Calculate ROI on Carriage House Construction and Rental Income

Let’s be realistic: building a carriage house is an investment. But is it a wise investment? That’s where understanding your return on investment (ROI) becomes critical. This isn’t just about crunching numbers; it’s about making informed decisions that maximize your property value and secure your financial future. What’s the optimal strategy for generating a sustainable income stream with a positive return on investment?

Understanding the Foundations of ROI

How to calculate ROI on carriage house construction and rental income isn’t complex, but it requires meticulous planning and attention to detail. The basic formula is straightforward: (Net Profit / Total Investment) * 100 = ROI. However, applying this formula to a carriage house requires careful consideration of specific factors.

What constitutes “Net Profit”? It’s your rental income minus all operating expenses – construction costs, property taxes, insurance, maintenance, and potential vacancy periods. Total Investment? That includes everything from initial land preparation to final interior finishes, along with any associated financing costs.

Beyond the Basic Formula: A Comprehensive Analysis

A simple ROI calculation provides a starting point, but a truly comprehensive analysis necessitates a broader perspective. Let’s examine some essential factors:

- Construction Costs: Secure detailed and itemized quotes from multiple reputable contractors. Factor in permits, materials, labor, and potential unexpected expenses.

- Rental Income: Conduct thorough market research on comparable rentals in your area. Consider factors such as size, amenities, location, and current market demand. Be realistic about potential rental rates and occupancy rates.

- Financing: If you’re financing the project, incorporate interest payments into your expense calculations. This significantly impacts your short-term ROI and overall profitability.

- Property Taxes & Insurance: These are recurring expenses that must be accurately estimated and budgeted for. Contact your local tax assessor and insurance providers for accurate quotes.

- Maintenance & Repairs: Set aside adequate funds for routine maintenance, preventative repairs, and potential unexpected repairs. Think long-term to preserve the value of your investment.

- Vacancy: Account for potential periods where the carriage house might be vacant between tenants. This is a crucial expense often overlooked.

Leveraging Financial Tools for Accurate ROI

Several financial tools and metrics can refine your ROI calculation, providing a clearer picture of your investment’s potential and financial health.

- Cash-on-Cash Return: Ideal for financed projects, this metric illustrates your annual cash flow relative to your initial cash investment. It helps assess short-term liquidity and the immediate return on your invested capital.

- Net Operating Income (NOI): This metric measures profitability before debt service (mortgage payments), offering a clearer view of the property’s operational performance and its ability to generate income.

*

- White On White Kitchen Backsplash: Is It Timeless? - November 20, 2025

- Backsplash Colors for White Cabinets: Find Your Perfect Match - November 19, 2025

- Backsplash Ideas for White Cabinets: Find Your Perfect Style - November 18, 2025